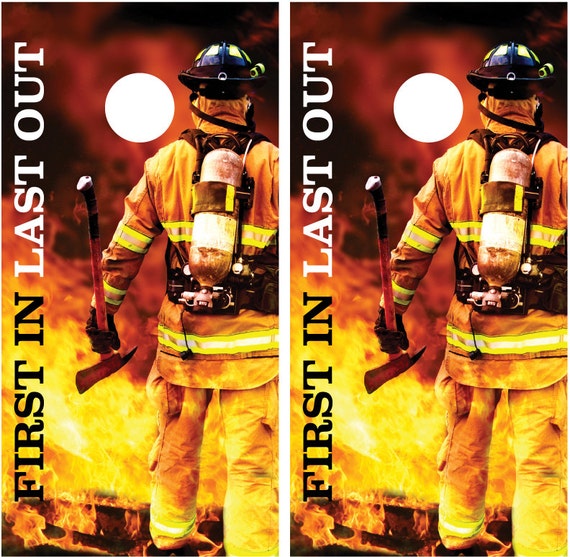

The last-in, first-out method works in exactly the opposite manner: you sell your newest shares first. The LIFO method typically results in the lowest tax burden when stock prices have increased.. Chief Salka’s books, “First In, Last Out” (2004) and “The Engine Company” (2009) are based on his experiences working in the FDNY from his appointment in 1979 throught the next three decades. Chief Salka writes and lectures on fire service subjects and Leadership to public service organizations, private industry, military and fire service.

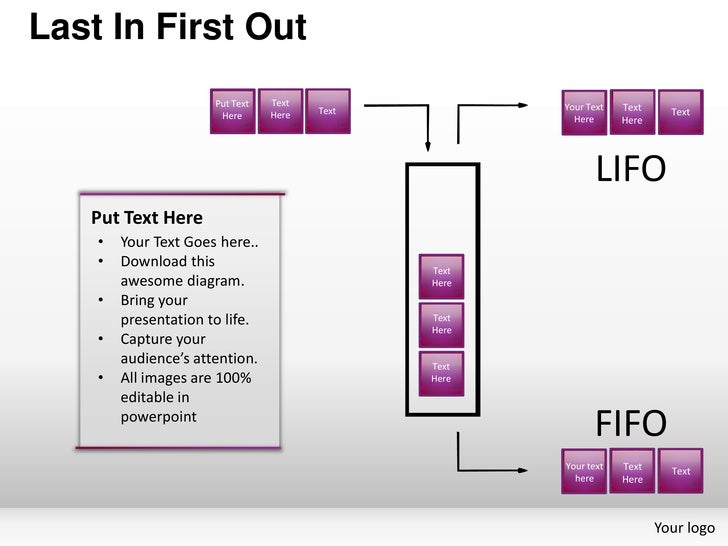

Last in First Out PowerPoint Template SketchBubble

Opposite wordcard for first and last 455875 Vector Art at Vecteezy

Firefighter Svg First In Last Out Fireman SVG Red Line Svg Etsy

First In, Last Out Leadership Healthy Leaders

Last in first out powerpoint presentation templates

Last in first out stock illustration. Illustration of method 104614224

Firefighter First In Last Out Everybody Goes Home Vinyl Decal Sticker

Steven Erikson Quote “First in, Last out. Motto of the bridgeburners.”

Order Firefighter First In Last Out Flag from Brightroomy now!

Steven Erikson Quote “First in, Last out. Motto of the bridgeburners.”

First in last out svg firefighter svg clipart fire dept png Etsy

Destiny 2 First In, Last Out Guide How to Get First In, Last Out & the God Roll

Firefighter Photo First In Last Out Flames

First In, Last Out Destiny 2 DB

Filo First Last Out Image & Photo (Free Trial) Bigstock

Vinyl Decal First In Last Out Fire Fighter firefighter truck Etsy

First In Last Out Every One Goes Home SVG PNG DXF

Premium Vector Firefighter first in last out tshirt design

First In Last Out Firefighter Shirt

“First In Last Out” Sticker for Sale by wolfgangrainer Redbubble

The last in, first out, or LIFO (pronounced LIE-foe), accounting method assumes that sellable assets, such as inventory, raw materials, or components, acquired most recently were sold first. The last to be bought is assumed to be the first to be sold using this accounting method. (In contrast, FIFO – first in first out – assumes the oldest.. Last-in First-out (LIFO) is an inventory valuation method based on the assumption that assets produced or acquired last are the first to be expensed. In other words, under the last-in, first-out method, the latest purchased or produced goods are removed and expensed first. Therefore, the old inventory costs remain on the balance sheet while the.